E/M Coding Makes OIG 2011 Work Plan

Make sure your postop office visit documentation measures up.

The OIG has once again set its sights on several new targets to go with the upcoming new year, and this time the feds will be double- and triple-checking your E/M documentation.

On Oct. 1, the OIG published its 2011 Work Plan, which outlines the areas that the Office of Audit Services, Office of Evaluations and Inspections, Office of Investigations, Office of Counsel to the Inspector General, Office of Management and Policy, and Immediate Office of the Inspector General will address during the 2011 fiscal year. When the OIG targets an issue in its Work Plan, you can expect the agency to carefully review and audit sample claims of those services.

The Work Plan “describes the specific audits and evaluations that we have underway or plan to initiate in the year ahead considering our discretionary and statutorily mandated resources,” the document indicates.

On the agenda for next year, the OIG has indicated that its investigators will “review the extent of potentially inappropriate payments for E/M services and the consistency of E/M medical review determinations.” The OIG also plans to hone in on whether payments for E/M services performed during the global periods of other procedures were appropriate.

In addition, the OIG will scrutinize Medicare payments for Part B imaging services, outpatient physical therapy services, sleep testing, diagnostic tests, and claims with modifier GY on them (Item or service statutorily excluded, does not meet the definition of any Medicare benefit or, for non-Medicare insurers, it is not a contract benefit).

The OIG also intends to “review Medicare payments for observation services provided during outpatient visits in hospitals” to assess whether hospitals’ use of observation services affects Medicare beneficiaries’ care.

Keep your compliance plan up to date with tips from Part B Insider,...

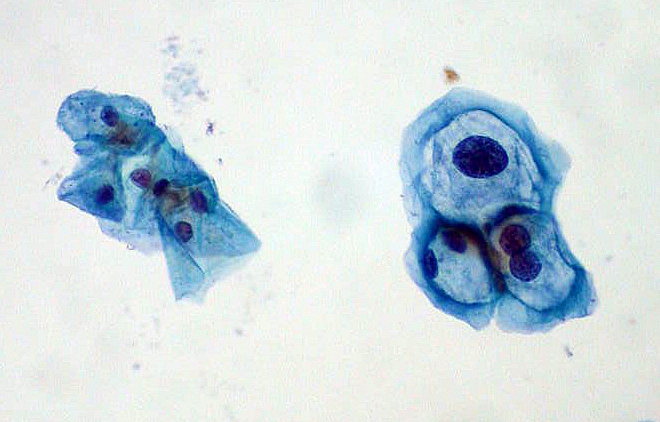

When a patient returns to your office for a repeat Pap smear, you’ve got to weigh your options of E/M and specimen handling codes, as well as diagnosis codes. Take this challenge to see how you fare and prevent payment from slipping through your fingers.

When a patient returns to your office for a repeat Pap smear, you’ve got to weigh your options of E/M and specimen handling codes, as well as diagnosis codes. Take this challenge to see how you fare and prevent payment from slipping through your fingers. Say goodbye to form 4010A1 for ICD codes as well, starting in 2012.

Say goodbye to form 4010A1 for ICD codes as well, starting in 2012.