MACs won’t process June claims until today, in hopes that Congress will act.

MACs won’t process June claims until today, in hopes that Congress will act.

The Senate’s delays could mean serious payment crunches for your practice.

Last month, the freeze that has been keeping the Medicare conversion factor at 2009 levels expired, meaning that Part B practices were due to face a 21-percent cut effective for dates of service June 1 and thereafter. Because Congress had not yet intervened to stop those cuts, CMS initially instructed MACs to hold claims for the first 10 business days of June while lawmakers could deliberate whether to eliminate the looming cuts.

When the Senate reconvened on June 7, many analysts expected its members to vote on H.R. 4213, “The American Jobs and Closing Tax Loopholes Act of 2010,” which was expected to increase your payments through the end of this year, according to the text listed on the House Ways and Means Committee Web site. However, the bill has not passed, leading CMS to extend the MACs’ claims hold through June 17.

According to a June 14 CMS notification, the agency directed its contractors “to continue holding June 1 and later claims through Thursday, June 17, lifting the hold on Friday, June 18.”

CMS acknowledged in its June 14 notification that the lengthened claims hold period “may present cash flow problems for some Medicare providers. However, we expect that the delay, if any, beyond the normal processing period will be only a few days.”

The impact of the 17-day claims hold will vary, depending on the practice and how many Medicare patients it sees, says Quinten A. Buechner, MS, MDiv, CPC, ACSFP/GI/PEDS, PCS, CCP, CMSCS, president of ProActive Consultants in Cumberland, Wis.

Those practices with large Medicare populations could face a cash flow crisis, says Barbara J. Cobuzzi, MBA, CPC, CENTC, CPC-H, CPC-P, CPC-I,...

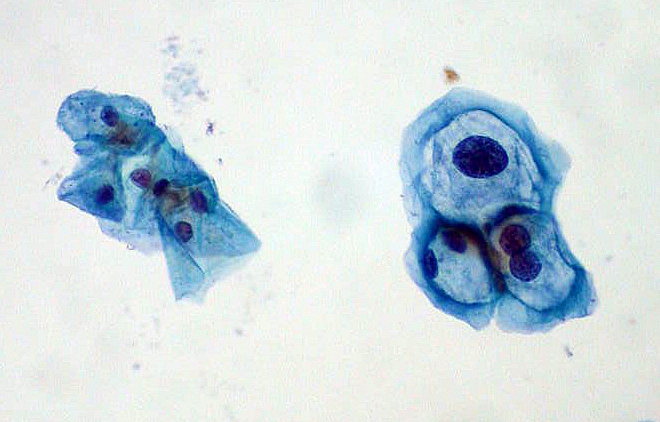

When a patient returns to your office for a repeat Pap smear, you’ve got to weigh your options of E/M and specimen handling codes, as well as diagnosis codes. Take this challenge to see how you fare and prevent payment from slipping through your fingers.

When a patient returns to your office for a repeat Pap smear, you’ve got to weigh your options of E/M and specimen handling codes, as well as diagnosis codes. Take this challenge to see how you fare and prevent payment from slipping through your fingers. Say goodbye to form 4010A1 for ICD codes as well, starting in 2012.

Say goodbye to form 4010A1 for ICD codes as well, starting in 2012.